This post was initially written in November 2018. This is the latest iteration as of April 2020.

When I first started writing this blog I set out a very brief goal:

Financial independence for myself and MrsFireShrink.

But beyond that, the aim is to save a sufficient amount to create a self-sustaining portfolio. The dream goal being to create a portfolio sufficient to support my family in the future and continue to grow (1).

Which is all a bit wishy-washy. As time and this blog has gone on I’ve developed a clearer idea of where I want to get to. I enjoyed indeedably’s goals post, and so I’ve emulated that here (2). So here’s the current goals list with steps already taken and timescale for target/ dream/ fail. (Last updated Jan 2021).

Complete medical degree.Achieve Royal College Membership.Become a consultant (2028).Find a girl.Get married.Have kids (2028). Have good kids.Publish a paper (2018). Get a fellowship (2019). Get another fellowship (2019).Get a Phd. Get a lectureship. Make Prof.Get a job.Get a job I enjoy.Get a job which doesn’t feel like work (2020).Be in a position to retire in 20 years (2038).Have an emergency fund of three months income (2019).Save £1000/month (2020 2021)Have a net worth of £100k.Have a net worth excluding property equity and NHS pension of £100k (2030).Own a home.Have £100k in equity (2023).Learn to drive.Own a car.Own a six-cylinder car.Own an eight-cylinder car (2028).Race in a motorsport.Win a race (no timescale).Start a martial art.StartGet to sho dan (no timescale).gradeing.- Learn to ride a motor bike.

- Learn to fly a plane.

Do 50 press-ups.Do a pull-up (again) (2019/20/21).Get back to 17 stone (. Do a hand-stand press-up (again). Do a ring muscle-up.2019/20)- Re-learn languages I once knew. Become fluent in one of them. Learn a fourth language (no timescale).

The Numbers

Most of the maths in this section is rough and dirty. I’m not going to make complex predictions or models. Life itself is too unpredictable (even if the money isn’t), and past predictions have demonstrated the fallacy of trying to predict the future.

- Be in a position to retire in 15 years (2033).

In the past I have conservatively estimated I will need around £24k a year to maintain our current lifestyle if I didn’t work. Looking back at figures for 2019, my expenses plus half the household running costs comes to £23.5k, excluding mortgage and credit card payments. Good consistency, and also fits nicely with what the fun Standard Life calculator reckons for our current lifestyle (~£23,000) (3).

Plugging that into a simple interest calculator suggests I need to have around £700,000 saved to be able to withdraw £24,500/year at a reasonable 3.5% interest rate with no erosion of capital. This presumes the savings will be tax-sheltered, and does not account for inflation. As inflation works on both denominator and numerator it’s not worth calculating here, but I will recalculate as I go. I’ve selected 3.5% as a conservative blend of cash interest rates (currently ~1%) and the average annual return of the FTSE All-Share over the last 100 years (+7.0%) (4). It’s also conveniently the mythical Perpetual Withdrawal Rate (5, 6).

You say: “Why are you not interested in drawdown? You’d get to retirement a lot quicker.”

The figure above would replace my current salary (7). My NHS pension kicks in from age 68 onwards and would provide career-averaged salary revalued by inflation. If I bridged to 68 with ISAs, say for 15 years, suddenly my required capital savings halves. But that requires capital drawdown, and would also reduce my NHS pension unless I paid for an early retirement buyback. I expect the NHS pension to be the subject of future Government cash raids, and would prefer redundancy in my financial system. For that same reason I haven’t included the State Pension. I also think drawdown is highly personal, and relates among other things to your optimism for your life expectancy, number of dependants and general approach to lifestyle. In future years as my pot grows I may change this attitude and run models, but right now it’s all about accumulation.

- Save £1000/month (2020). Save £1500/month (2025). Have a net worth of £100k.

Stepping stones on the route to the previous bullet point. Plugging that £700,000 into Money Advice Service’s savings calculator suggests I need to be saving £1835/month at 5% interest to achieve retirement by 2038 (8, 9). Long term readers may notice I’ve pushed the date out, and it’s now a bit more realistic. The amount I’m saving is incrementally increasing, but still a way off required sum. I suspect I’ll miss this target barring spectacular stock returns.

- Have £100k in equity (2023). Start overpaying mortgage (2023). Have 180k in equity (2028). Buy our dream home in 10 years (2028).

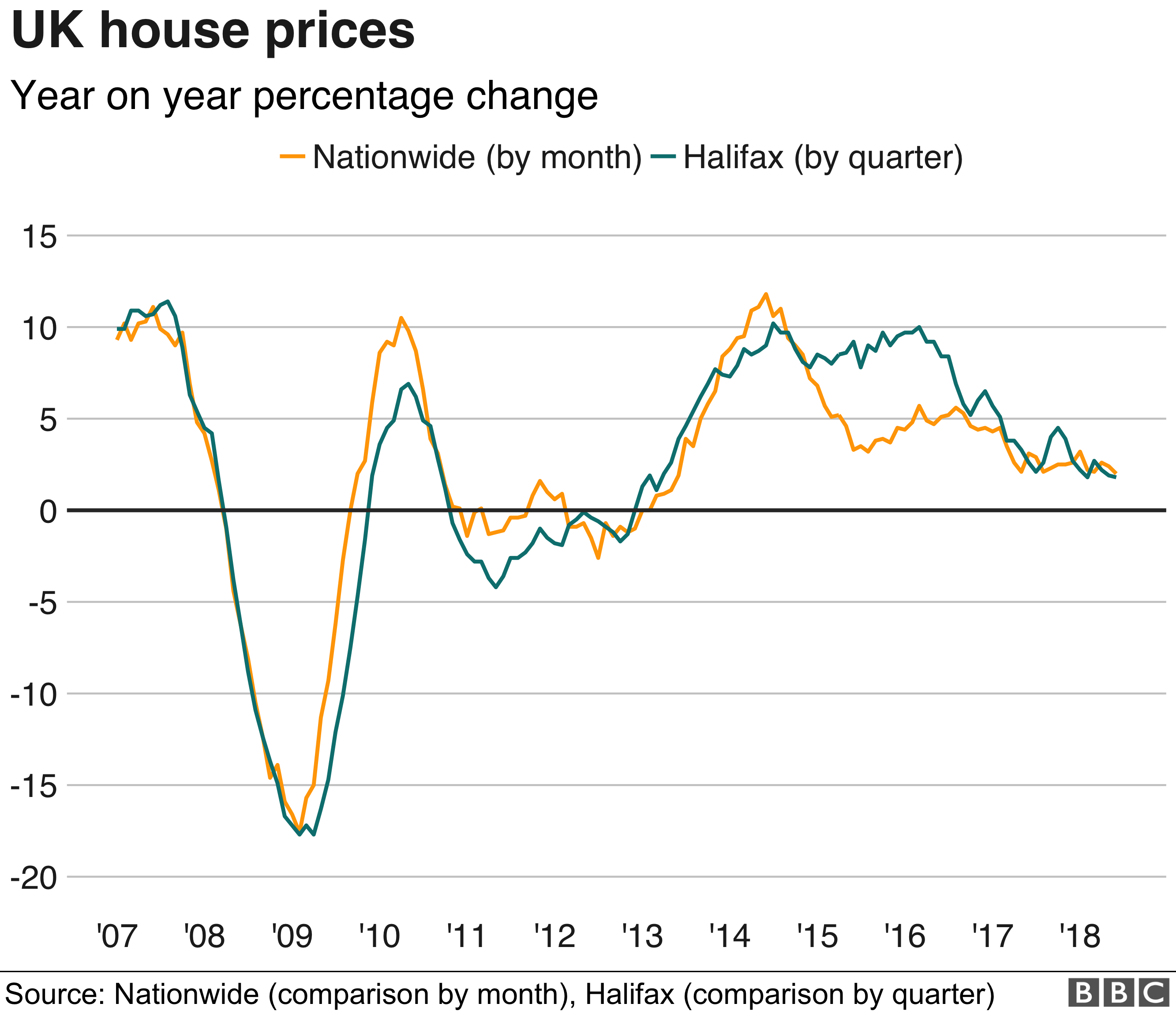

Currently our dream homes cost around £500k. Difficult to say what that will be in 10 years time. Historically the yearly trend has been c2.9% (10). More recently it’s closer to 2%, comparable to the OECD 2.0% long-range inflation forecasts (11, 12). Inflating the £500k at 2% brings us to £610k in 2028. Our feet are on the ladder, which mean we also benefit from that inflation to an extent.

When this was first written in late 2018 we had around £67k in equity. I hoped to reach £100k by 2023. We’re now (Q1 2020) at around £85k, thanks to moderate house price growth and a remortgage knocking down our interest rate. Overpaying our mortgage once we have a decent joint emergency fund will also help. I’ve added a new target constituting a 30% deposit on a potential dream home in 2028.

Summary:

- Save £1000/month (2020)

- Be worth £100k (2022)

- Start overpaying mortgage (2023)

- Have £100k in equity (2023)

- Be in a position to retire in 20 years (2038)

In part 3 I cover my asset allocation.

Take care,

The Shrink

References:

- https://thefireshrink.wordpress.com/about-me/

- https://indeedably.com/i-will/

- https://www.standardlife.co.uk/c1/guides-and-calculators/retirement-how-much-may-i-need.page

- http://stockmarketalmanac.co.uk/2016/12/100-years-of-the-ftse-all-share-index-since-1917/

- https://portfoliocharts.com/2016/12/09/perpetual-withdrawal-rates-are-the-runway-to-a-long-retirement/

- https://monevator.com/what-is-a-sustainable-withdrawal-rate-for-a-world-portfolio/

- http://monevator.com/try-saving-enough-to-replace-your-salary/

- https://www.moneyadviceservice.org.uk/en/tools/savings-calculator/

- http://candidmoney.com/calculators/investment-target-calculator

- http://monevator.com/historical-uk-house-prices/

- https://www.bbc.co.uk/news/business-44736472

- https://knoema.com/rwbagv/uk-inflation-forecast-2018-2020-and-up-to-2060-data-and-charts

Hi TFS, hope you are well.

Interesting that you’ve taken this opportunity to review your goals. I think I’m going to wait out this current madness and perhaps take a look next year as I’ll have a clearer idea of what needs to be changed then.

All the best with your shodan – I still consider getting mine to be one of my best personal achievements.

Take care and keep safe!

LikeLiked by 1 person

Thanks Weenie, hope you and family are well too.

It’s not seemed to affect me too much; I’ve got so little invested and the majority of my goals so far have been about building a platform to invest – eliminating debt and building an emergency fund. Financially I’m probably one of those who will lose the least and gain the most. Do not envy you or others who are seeing the big drops!

A few years yet to that grading, but all the sweeter for the efforts. I’m really missing training with the lockdown.

Hope the nephew is keeping you amused!

LikeLiked by 1 person