Quarterly return posts supplement my monthly Financial Dashboard, covering investments in detail and looking at my yearly targets. Here I track purchases and sales, document progress against my (in progress) investment strategy, and discuss re-balancing and changes over time.

Year two of tracking down, time for another review. After the tumult of 2018, 2019 has been a year of consolidation. There were no house moves, no big projects or events, and only one foreign holiday. It’s been a year focusing on finances and career, steadying and preparing for some big bills and life changes in 2020. But how did I get on for my 2019 goals?

Q4 Returns:

- Cash Savings Accounts £7,600 (+3,200)

- Investments £2,990 (+£1,440)

- Property £40,500 (+£6,100)

- Cars £2500 (£0)

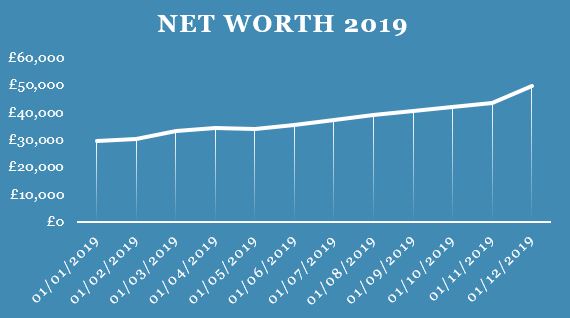

My net worth now sits at £~49,700, a significant increase of £20k over the course of the year. I set a goal as part of my yearly targets to save 25% of my income in 2019. I narrowly missed out when you look at raw saved cash and investments, saving only 23.53% (15.59% pre-pension).

Yearly Targets:

Goal 1: Build an emergency fund

My first 2019 goal was to build an emergency fund, as per the r/UKpersonalfinance flow chart (1). My goal emergency fund is three months total household expenses (£6k) in my name, plus a further three months (£6k) held jointly.

I now currently hold £6,700 in my name, and £1,800 held jointly. I reached the £6k figure as I’d hoped, but I’m not going to rest on my laurels. I currently hold over half of my emergency fund in high interest current accounts, and I’ve found it irritating to meet the requirements of my FlexDirect account (certain amount of transactions, certain amount in/out). The FlexDirect bonus rate is up fairly soon, and most of the high interest current accounts have dried up with rates falling back to those matching regular savings accounts (2, 3). When the interest period is up I’ll move it over to somewhere like Marcus. I also have £1.5k in my Starling account. Some of that is saved for a new car rather than a simple emergency fund, and in anticipation of that expense I’m going to be paying into my 3% Monmouthshire Regular Saver for the next ten months. Our joint account also pays into a regular saver, and I need to have a think about how I’m going to increase our joint emergency fund alongside paying for some property renovation work in the next few months. This will therefore remain a goal for 2020.

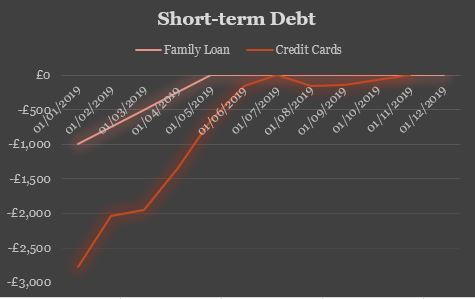

Goal 2: Pay off short-term debts

This was achieved in Q3, but I may yet make a dip into short-term borrowing to buy a replacement car or to pay for building costs. Some of you may be screeching ‘lifestyle inflation’, and I take the criticism. My reasoning is this: as described in the Bangernomics 2019 post, my current car is due some a serious amount of repair work and pro-active maintenance. This will cost more than it is worth. Rather than spending this money for no gain, the temptation is to trade in for the next cheap and cheerful daily. I am as yet undecided, and while I am deciding I accrue further savings to purchase outright. As for the property matter, we have renovated six of the eight rooms in our house. One of the final two needs some structural work, and is generally vile. The work is going to cost maximum £8-10k. With that done we will have a finished home in a sought-after area, which will be readily marketable if we ever had to sell quickly. Getting the work done ASAP will give us a generally nicer life, and increase our liquidity. We’ll use a combination of savings, 0% interest credit cards and possibly borrow again from family. Not ideal, but it fits our joint choices.

Goal 3: Save 25% of my earnings

I calculate my savings rate using this formula:

Savings rate as % = ((Income – spend) + Cash savings + Investments + Pension contributions) / (Income + Pension contributions)

So I sort of missed this goal. Remember how I said my raw saved cash and investments, for 2019 was only 23.53% (15.59% pre-pension). It’s always bugged me that my savings rate doesn’t include my mortgage payments. The increase in equity from the principle payment is a form of savings, right? So I changed my formula…

Savings rate as % = ((Income – spend) + Cash savings + Investments + Pension contributions + (half of principle mortgage payment)) / (Income + Pension contributions)

This makes more sense to me, as it means my savings rate comes closer to my absolute increase in net worth. Based on those numbers, my average savings rate for 2019 was 29.61%. My net worth saw a tasty 69% increase over the year, helped in part by increased equity as our property value went up. With this new formula, and a plan for incremental improvements, I aim to save 30% of my income in 2020.

Goal 4: Live more sustainably

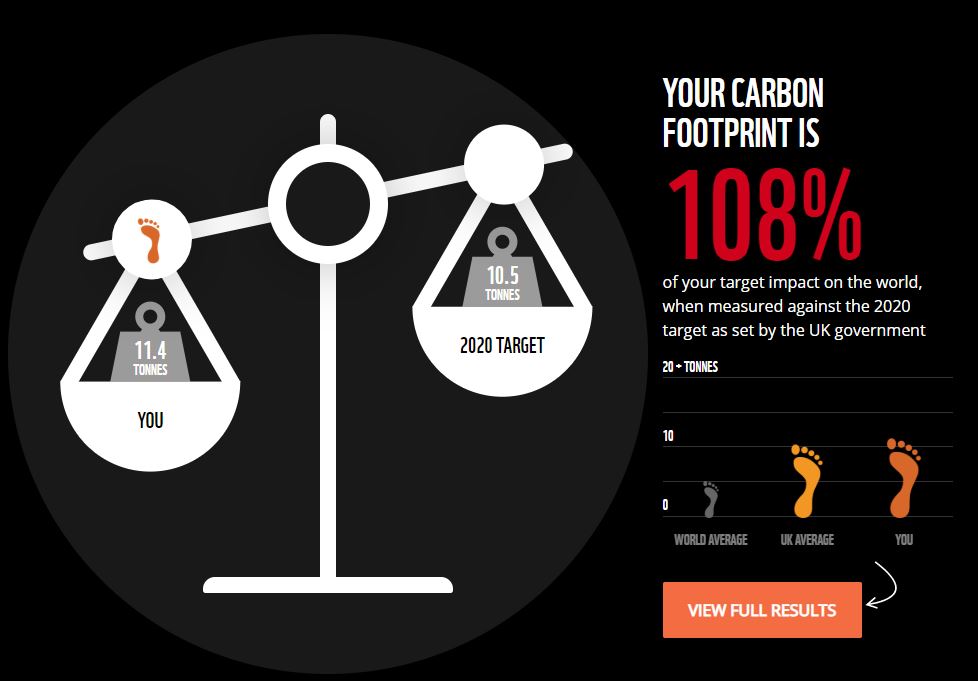

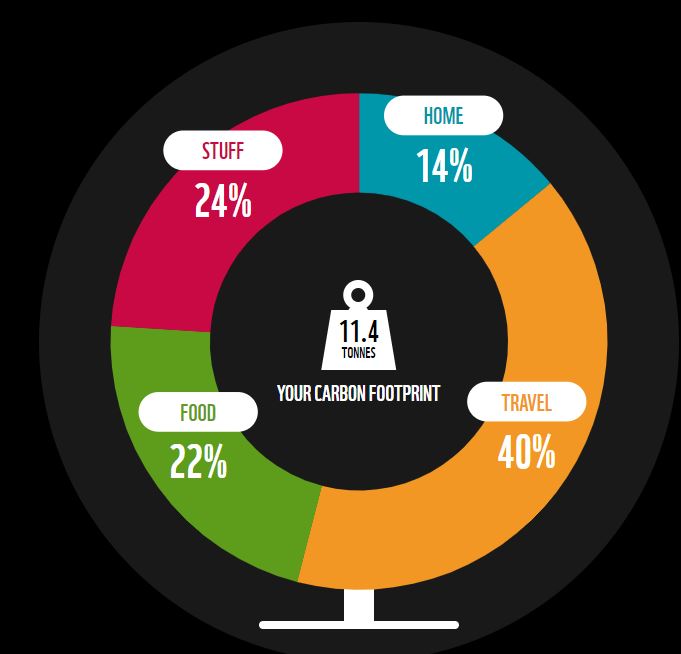

Way back in January I took the WWF Carbon Footprint calculator, and we had a whopping 169% of our target footprint. At the end of the year, the calculator estimates we’re now down to 108% of the UK Average.

The main improvement has been from reducing my travel footprint through fewer flights. Our diet is more healthy, more local and seasonal. We lose points for the new furniture we’ve bought, our meat consumption (I have many thoughts challenging this, but for another time), and my work car commute. I refuse to damage my cavity walls with insulation. I think the loose top line goal has helped with all the simple changes we can make, so now it’s time to look in a little more in depth way. First, I want to know how much I’m saving by growing my own. Second, I want to look at changes I can make to reduce my carbon footprint.

Goal 5: Commence investing

As a yearly goal, this is a win. I’ve gone from nought to £2,990 in investment accounts and seen a healthy return on my invested capital. I’m aware this is pretty small potatoes for most FIRE bloggers, but this is not a pension or a SIPP. The NHS pension provides me with (theoretically) something better (supposedly) than either. This is me breaking the psychological initiation barrier on a good old ISA. The next step will be to reduce cognitive drag, and automate.

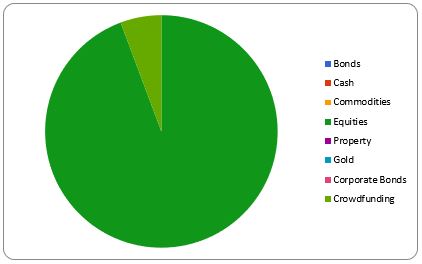

My investments remain solely in Crowdfunding and my Vanguard ISA. I have a small amount in my FreeTrade account, mainly there to be available for the free share offer. If you want a free share for joining FreeTrade, drop me an email.

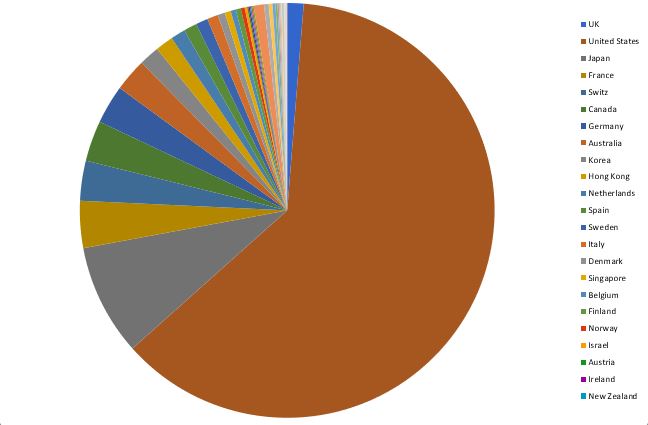

In the passive core of my investments, I paid irregular sums into my existing holdings (Developed World ex-UK and FTSE Global All Cap). Automating my investments should regulate the amounts, and following my incremental plan, I’m going to increase the amount I try to put in every month by £50. Looking at the graphs would suggest I’m US-heavy, as the market would expect. This visual representation bothers me, because although it’s true of my ‘portfolio’, it’s not true of my net worth. The vast majority of my that is in the UK housing market. I find myself talking across purposes, with goals and targets that differ depending on whether I’m talking about the ‘portfolio’ or total net worth. This is something I’ll be looking at in 2020, as I try to build my investments to diversify away from UK savings and property equity.

All this talk leaves me with the following 2020 Goals:

- Goal 1: Build an emergency fund

- Goal 2: Save 30% of my income

- Goal 3: Calculate savings made by growing my own food

- Goal 4: Make changes to reduce carbon footprint

- Goal 5: Automate investments and savings

Good luck to everyone with their own 2020 targets,

The Shrink

References:

Interesting reading this and the Bangernomics post recently. I do find being a petrol-head and tech enthusiast a nuisance when I also plan to be financially independent in my 50s too. Though I am 30 currently so hope to have a good few years to get where I want. One issue I had in my previous none financially savvy self was that I took on a large car PCP. I struggle with the idea of voluntary termination and getting a banger as we do travel Europe in the car each year so having a reliable and efficient car is of some use.. Though having 18k left to pay after already owning the car for 2 years is a constant thorn in my side..!

LikeLiked by 1 person

Understand the struggle, though I’ve always managed to avoid PCP. I was brought up to not equate reliability and efficiency with newness. My classic can theoretically do 50-60mpg reliably, it just needs some tweeking first.

Thanks for reading!

LikeLike

Hi Mr Shrink,

Could you send me an invite to Freetrade please?

Many thanks,

Sam

________________________________

LikeLike

Hi Sam,

If you drop me an email to the link in my About me page (any questions bit) then I’ll get the relevant details and send it across.

Cheers,

The Shrink

LikeLike

Hi Sam,

Link is:

https://freetrade.io/freeshare/?code=J0O5WPU4W2&sender=HVJidl0X

LikeLike