Continuing my current theme looking at crowdfunding, and in advance of some behavioural finance pieces I’m putting together, this week I’m pointing out some of the ways crowdfunding websites use cognitive biases to convince you to invest. For examples, I’ve pulled two pitches from Seedrs and CrowdCube which were at the top of their lists (1, 2).

In my opinion, some of the main cognitive methods that these sites use are:

- Bandwagon effect/ Confirmation bias

- Overconfidence effect

- Illusion of scarcity

- Denomination/ reciprocity effects/ present bias

Bandwagon effect/ Confirmation bias

Confirmation bias is the internal yes-man, that disregards data that contradicts your opinion and suggests that ambiguous information supports your opinion (3). Your search for, remember and interpret information subconsciously to prove you are right. The bandwagon effect refers to the tendency of people to follow others, regardless of whether it’s a good idea (4, 5). It stretches into and is allied with groupthink and herd behaviour. It’s common in politics and consumer economics, and was also seen in the Dotcom bubble. Here confirmation bias and the bandwagon effect work in tandem, people will invest along with others thinking that it is evidence that they are making the right choice.

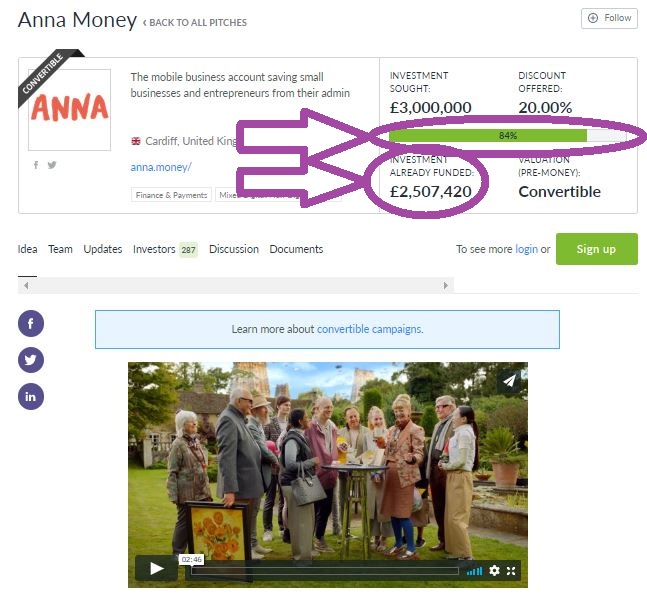

In the two examples chosen, you can see (circled in orange) that the number of investors and their commitment to a theoretical goal valuation are given pride of place in the ‘pitch’. Both websites aim to convince you that it’s a good idea, as many others are doing the same. Others must have done the research (social loafing), and they’ve committed (sunk cost fallacy), so you should too.

Overconfidence effect

Tied into confirmation bias, the overconfidence effect is the subjective belief that a persons ability is greater than the objective results would suggest (6). This should be well known to anyone who has read Smarter Investing etc, and is the basis of the active investment mindset. It’s also the whole basis of the Crowdfunding system, offering a variety of ‘pitches’ which you then evaluate, thinking ‘I have the edge others do not’. It’s worth noting in this that. Adding to this, optimism bias makes you think you are less likely to have a negative outcome (like a company failing) than others.

To help you on your way in your overconfident selection, the websites use the framing effect (7). Information is presented in a positive manner. These are, after all, advertising pitches. Every page will play-up it’s ongoing good points. Causes of concern are never mentioned (except perhaps in the discussion section). To look at the company financials often requires an investment or access request, inhibiting due diligence.

Illusion of scarcity

Scarcity, in human psychology, boils down to the fact that we as humans place greater value on things which are rare than those which are common (8). The scarcity heuristic is the mental shortcut we do when we say, ‘this thing is rarely available, therefore it must be worth more’. Salespeople employ this to great effect as the basis for mark-down discounts, Black Friday, and the perpetual DFS sale. Scarcity can come from quantity, rarity or time. For quantity, our innate reaction to finding out there is a limited quantity of something is to believe our choice to have that something is threatened, and therefore we want it more. For rarity, we place value on items we perceive to be unique. In companies this is often played on with pro-innovation bias, where we will favour innovation over the status quo and ignore flaws in the innovation (9). Such a pitch could be ‘look at our innovative unique idea, set to change the world’. For time, the scarcity heuristic is simple; time is running out, you don’t have time to do the complex thinking, the short cut answer is to buy, buy, buy.

Once again these methods are front and centre of our two chosen pitches. You have limited time left to choose (time scarcity). There’s a limited quantity of available investment (quantity scarcity), at odds with the over-funding concept. Ask yourself why the data is being presented in this way?

Denomination/ reciprocity effects/ present bias

Denomination effect is a cognitive bias in currency where people are more likely to spend an equivalent value in small denominations than in large denominations (10). I see this alot, as MrsShrink will actively avoid spending big sums, but £<10 in Tesco on tat twice a week is not an issue. You are more likely to buy multiple small crowdfunding investments than one large investment, which also fits with diversification bias, the tendency to opt for a selection which gives you options or variety in the future (11).

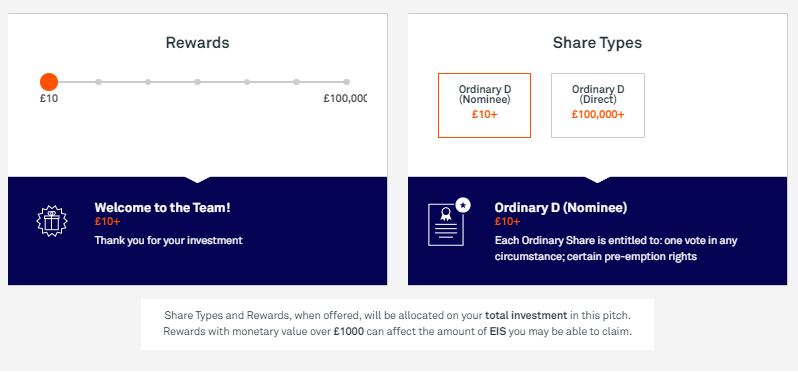

Crowdfunding sites pitch your investments in small amounts. They also offer rewards, which works on reciprocity effects and present bias. Reciprocity is responding to a positive action with a positive action, leading to positive regard from both sides (12). If the company rewards you for an investment, you are more likely to see it in a good light. You are also more likely to pick a company which rewards you for an investment due to present bias (13). This incorporates hyperbolic discounting, but essentially can be said that if we are offered £100 tomorrow or £100 in a month, we’re more likely to choose tomorrow. If we’re offered £100 tomorrow or £110 in a month, the choice will depend on the person and how much they discount the worth through time delay. As all crowdfunding investments are essential gambles set for an uncertain future, a present day reward sways our choices.

TL:DR

These are just a few of the methods that crowdfunding websites use to part us from our hard-earned. There are many, many more, and I encourage everyone to read up on behavioural finance and understand when cognitive biases may be at play. The post may come off as harsh, so know that I invested in the last month on one of these crowdfunding platforms. It’s all about doing your homework and looking beyond the sales pitch. If you can be bothered.

Have a great week,

The Shrink

Other News

- WeWork has pulled its IPO (14)

- Sajid Javid is planning to raise the living wage by 2024 (15)

- Japan has upped it’s consumption tax, spooking Asian markets (16)

- House price growth has flatlined in the last year (17)

- And the UK looks set for a recession, but one which is only a ‘recession’ by 0.1-0.2% (18)

- And recession fears are present in the wider market, with a fair drop in the markets this week (19)

- Sirius Minerals remains a huge gamble HM Gov won’t take (20)

- A low carbon greenhouse project could produce a significant percentage of UK out-of-season tomatoes (21)

Opinion/ blogs:

- ERE updates on what he’s been up to in his retirement (22)

- Interesting, is a little simplistic, post about trying the FIRE approach in the US (23)

- Monevator has a 10 year reflection on passive returns (24)

- And puts readers questions to Lars Kroijer (25)

- Plenty of September results reports, first from GFF (26)

- One from Dr Fire (27)

- A review of the month from frugal cottage (28)

- Plus dividend income (29)

- And from the eagle (30)

- And from Sam at a simple life (31)

- Along with thoughts about saving for the future (32)

- MsZiYou is back blogging a lot, here’s her September net worth (33)

- And a September financial update from The Squirreler (34)

- And The Saving Ninja, who’s setting sights on a new job (35)

- A net worth update from Playing with FIRE (36)

- A new one to me, Monethalia, also has a monthly savings report (37)

- As does A Way to Less (38)

- Firevlondon has a Q3 review (39)

- Getting Minted has a general portfolio review (40)

- Grizgal wonders about the necessity of a personal pension (41)

- A rare single post week from Indeedably, with this about setting yourself apart (42)

- And the FI Fox has suggestions on how to combine finances as a couple (43)

- John the UKVI looks at hidden debt in the form of lease obligations, one of the harbingers for WeWork (44)

- The DIY Investor UK adds ITM Power to his holdings (45)

- And RIT brings us a his Q3 review (46)

The kitchen garden:

What I’m reading (affiliate links):

Food Of The Gods: The Search for the Original Tree of Knowledge: A Radical History of Plants, Drugs and Human Evolution – Terence McKenna – An ethnobotanist explores humanitys’ fascination with hallucinogenics, and the role of altered states of consciousness on the development of human society.

References:

- https://www.seedrs.com/anna-money/sections/investors

- https://www.crowdcube.com/companies/justpark-1/pitches/bk7Aeb

- https://en.wikipedia.org/wiki/Confirmation_bias

- https://www.investopedia.com/terms/b/bandwagon-effect.asp

- https://en.wikipedia.org/wiki/Bandwagon_effect

- https://en.wikipedia.org/wiki/Overconfidence_effect

- https://en.wikipedia.org/wiki/Framing_effect_(psychology)

- https://en.wikipedia.org/wiki/Scarcity_(social_psychology)

- https://en.wikipedia.org/wiki/Pro-innovation_bias

- https://en.wikipedia.org/wiki/Denomination_effect

- https://humanhow.com/en/list-of-cognitive-biases-with-examples/

- https://en.wikipedia.org/wiki/Reciprocity_(social_psychology)

- https://en.wikipedia.org/wiki/Dynamic_inconsistency

- https://www.bbc.co.uk/news/business-49884247

- https://metro.co.uk/2019/09/30/chancellor-sajid-javid-raises-national-living-wage-10-50-10834020/

- https://www.bbc.co.uk/news/business-49849484

- https://www.bbc.co.uk/news/business-49891141

- https://www.bbc.co.uk/news/business-49919189

- https://www.thisismoney.co.uk/money/markets/article-7535061/Recession-fears-hang-global-economy.html

- https://www.thisismoney.co.uk/money/news/article-7541673/Cautious-Treasury-loses-Sirius-Minerals-millions-failing-company.html

- https://www.businessgreen.com/bg/news/3082227/new-gbp120m-low-carbon-greenhouse-project-set-to-deliver-one-in-10-uk-tomatoes

- https://www.getrichslowly.org/early-retirement-extreme/

- https://www.marketwatch.com/story/why-we-ditched-the-fire-movement-and-couldnt-be-happier-2019-09-30

- https://monevator.com/10-year-retrospective-what-a-decade-of-returns-tells-us-about-passive-investing/

- https://monevator.com/qa-thursday-with-lars-kroijer-session-1/

- https://gentlemansfamilyfinances.wordpress.com/2019/09/30/month-end-accounts-september-2019/

- https://drfire.co.uk/september-2019-report/

- http://www.thefrugalcottage.com/september-2019-a-month-in-review/

- http://www.thefrugalcottage.com/dividend-income-september-2019/

- http://eaglesfeartoperch.blogspot.com/2019/10/investment-review-september-2019.html

- https://asimplelifewithsam.com/2019/10/01/september-review/

- https://asimplelifewithsam.com/2019/10/04/saving-for-the-future/

- https://www.msziyou.com/net-worth-updates-september-2019/

- https://thesquirreler.com/2019/10/02/september-2019-update/

- https://thesavingninja.com/savings-report-15-getting-a-job-at-google/

- https://playingwithfire.uk/october-update/

- https://monethalia.com/monthly-savings-report-september-2019/

- https://awaytoless.com/monthly-spending-september-2019/

- https://firevlondon.com/2019/10/05/sep-2019-q3-review/

- https://gettingminted.com/reviewing-the-situation/

- https://grizgalonfire.com/do-i-need-a-personal-pension/

- https://indeedably.com/backwardation/

- https://thefifox.wordpress.com/2019/10/01/how-to-successfully-merge-finances-without-breaking-up-over-it/

- https://www.ukvalueinvestor.com/2019/10/the-hidden-debt-of-lease-obligations.html/

- http://diyinvestoruk.blogspot.com/2019/10/itm-power-finals-key-partnership.html

- http://www.retirementinvestingtoday.com/2019/10/human-being-and-2019-q3-review.html

- https://www.theguardian.com/food/2019/oct/03/always-cooking-the-same-thing-try-a-weekly-food-box

One thought on “The Full English Accompaniment – Cognitive biases in crowdfunding”