Over the course of the next few months, as the news is dominated by ‘OMG CORONAVIRUS TERROR’, I’ll try and stay off the topic. I couldn’t fail to discuss the changes in markets this week though. It’s quite hard to actually get a long term graph to show the progress of the market, so here’s one I knocked up using every week end closing value for the FTSE 100 since it’s inception:

At the start of last week, when I started writing this post, there was fear that we were in a correction, that there might be a larger drawdown. The market has moved fast, driven by anxiety. December 2018’s correction is suddenly a distant memory. There were plenty of potential threats, many detailed in SeekingAlpha’s article from last week (1). Everybody was already looking for a reason for recession, eyes peeled for the signs. What they didn’t expect was this viral black swan to come drifting serenely over the horizon before shitting all over the picnic (2, 3). That is the nature of the cause of a bear market; if it was predictable it could be expected and adjusted for. The cause will always emerge from the unknown unknowns.

What’s working now won’t always work

I’m not going to speak to the markers, numbers and hallmarks of a bear market. The figures and data used by investors are better discussed in that same SeekingAlpha article than I ever could (1). As it explains:

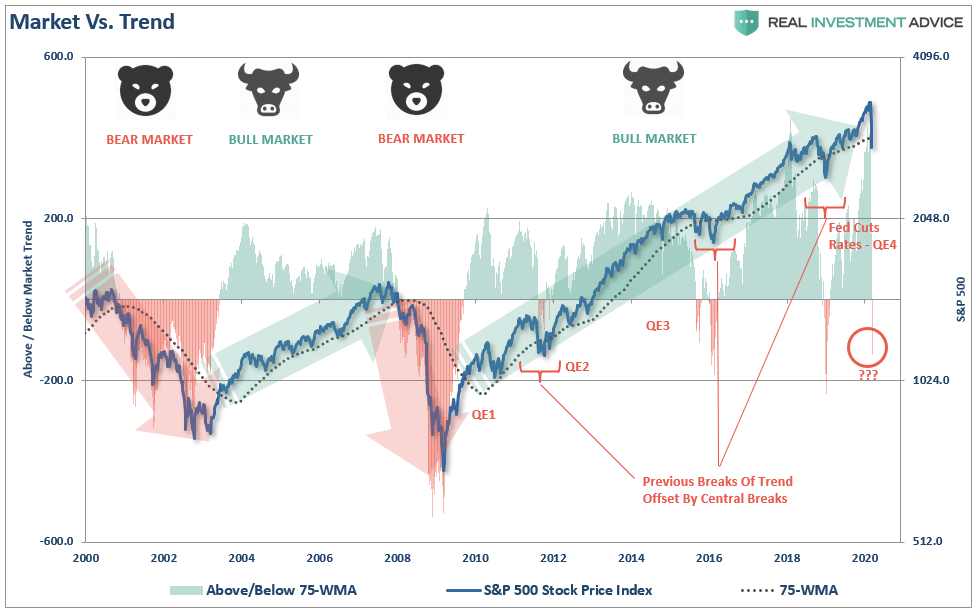

“Bull and bear markets are NOT defined by a 20% move. They are defined by a change of direction in the trend of prices.”

There have been times (see below) in the last decade where the long term moving average has trended downwards, but they have not resulted in a bear market. Quantitative Easing (QE) at those times has shored up the market and returned us to the Bull course. So what has changed? Looking at it from my stock and trade, I would have to say anxiety amongst the general public and uncertainty. When looking at data and analysis we often fall prey to cognitive biases; cherry picking evidence to support our decisions, applying selection bias (4, 5). We look for the news we want to see. When anxiety peaked previously amongst market investors the FED/ ECB/ BoE stepped in and applied QE. This reassured investors and dampened anxiety. Joe Public, for whom it was a blip on the road, were fairly nonplussed.

Image credit: Seeking Alpha/ Real Investment Advice

Was the market the boy that cried wolf too many times to central banks? That allegory was being touted last year, with the observation that the commitment from central banks to maintaining asset prices had left them unable to normalise policies without risking recession (6). At some point the propping up would no longer support the fall. This time, as the Fed/ BoE reached once again for the chequebook, it’s not worked. Instead it’s been called ‘misjudged’, and appears to have driven the markets further (7). Fear and anxiety has not been eased, it’s remained high. Anxiety amongst the general population, visible in panic buying and the general hysterical pitch of the news cycle, has infected the markets. The VIX, a measure of the stock markets expected volatility, shot up from a moderate baseline to the mid-70s last week, and is currently sitting around the 78 mark (8). That’s well into expected nosedive territory.

Is this a reversion to mean – Fed rate cuts usually accompany recessions because declining interest rates suggest wider economic deterioration. Hard nosed market timers have been scoffing at new normals (9).

Image credit: Elliott Wave International

‘All bull markets are the same, all bear markets are different’

So, as I write this on March 15/16/17th, the Fed has slashed the interest rate to 0-0.25% (10). It’s a hallmark of a bear trend, accompanying volatility. We’re seeing 4-12% swings daily. This market is the saw blade, whipping down through your investment logpile. But this market noise covers the underlying drivers; uncertainty and anxiety. The market thrives on certainty and predictable outcomes. COVID-19 is an unknown and can’t be priced into the efficient market. We’ve never had a virus driven recession we have data for (11). The Black Death, Smallpox and Plague of Justinian tell no tales.

We don’t know when it will end or what the fallout will be. People try to provide structure and certainty by reflecting on what can now be expected (12). They tell themselves it’s cyclical, that we’re in a recession and will bounce back (13). This market is not a response to internal cyclical events, or broad economic fallacies. This is the result of a pandemic threatening millions of lives and requiring a global response. The market won’t be able to price in the outcome until we’re past the peak of the virus, and we’re only just getting started. Leave your speculation at the door. Keep calm and carry on investing (14). As TI/ TA on Monevator intone:

We’ve all got bigger things to worry about.

Keep handwashing!

The Shrink

…

Thought for the week:

“It is a mark of a mean capacity to spend much time on the things which concern the body, such as much exercise, much eating, much drinking, much easing of the body, much copulation. But these things should be done as subordinate things: and let all your care be directed to the mind” – Enchiridion XLI, Epictetus

…

Other News:

Covid-19 mini-special:

Image credit: The Visual Capitalist (16)

- A history of pandemics (17)

- Even behavioural psychologists can’t help panic buying loo roll (18)

- A mere week ago we saw the biggest fall since 2008 (19)

- And we had the cracking “People you know will die” from our PM (20)

- This would appear to be the data from Imperial used by the government for modelling (21) – If you read one link, read this. Below is the graph if we do nothing.

Life goes on:

- New EU rules on obsolescence means back to repair and reuse (22)

- Small investors lose their life savings on Sirius Minerals (23) – The mis-selling claims begin… Don’t invest if you’re not prepared to lose it!

- And speaking of mis-selling, equity release are a brewing storm (24)

- In all this wildness there’s been a budget, including changes to the Taper (25)

- More analysis on the budget here (26)

Comment/ Opinion:

- Larry Elliott in the Guardian on the Coronavirus recession (27)

- Vanguard’s CEO speaks out to investors (28)

- Monevator has updated it’s ‘How to prepare for a recession’ post (29)

- Covert FIRE article on CNBC about a 27 year old millionaire (30)

- And a bit in the Metro about a young couple living off £5k a year (31)

- Of Dollars and Data on theories becoming reality (32)

- John at UKVI continues to hunt dividends (33)

- Newcomer Finumus has a great post about bonds (34)

- The DIY Investor UK is rechecking his asset allocation (35)

- And has some serious churn, adding National Grid (36)

- RIT adds sensible views on the current market, and is rebalancing (37)

- The Eagle has reflections on his portfolio performance (38)

- And provides an amazing perspective of experience in isolation abroad (39)

- GFF has a very brief month end account (40)

- While the ways have more detail (41)

- Weenie’s dogs of the FTSE is not having a great time (42)

- Firevlondon appears to have done more in a couple of weeks than I do in a year (43)

- The Frugal Cottage has provided us with an updated view of their holdings (44)

- New blog South Wales FI has reflections on IFISAs and P2P (45)

- Banker on Fire debates Pensions vs ISAs (46)

- Pursue Fire makes a data driven argument about how investments are all about the long view (47)

- While TEA addresses it from a more person-centred viewpoint (48)

- And finally, Indeedably is all wonderfully Indeedably about who with and where we shack up (49)

References:

- https://seekingalpha.com/article/4330865-technically-speaking-on-cusp-of-bear-market

- https://en.wikipedia.org/wiki/Black_swan_theory

- https://monevator.com/investing-in-the-face-of-a-disaster/

- https://en.wikipedia.org/wiki/Cherry_picking

- https://en.wikipedia.org/wiki/Selection_bias

- https://www.marketwatch.com/story/the-fed-put-on-the-stock-market-may-expire-worthless-because-of-these-mistakes-stifels-bannister-2019-09-19

- https://www.telegraph.co.uk/business/2020/03/04/feds-misjudged-pyrotechnics-may-have-brought-us-even-closer/

- http://www.cboe.com/vix

- https://www.forbes.com/sites/investor/2019/07/27/the-fed-is-going-to-cut-rates-be-careful-what-you-wish-for/#4ed414f560b2

- https://www.theguardian.com/business/2020/mar/15/federal-reserve-cuts-interest-rates-near-zero-prop-up-us-economy-coronavirus

- https://www.marketwatch.com/story/goldman-sachs-analyzed-bear-markets-back-to-1835-and-heres-the-bad-news-and-the-good-about-the-current-slump-2020-03-11

- https://www.forbes.com/sites/simonmoore/2020/03/14/what-to-expect-from-this-bear-market/#4def34e661ff

- https://www.cnbc.com/2020/03/14/not-every-bear-market-is-accompanied-by-an-economic-recession-but-chances-are-high.html

- https://www.ukvalueinvestor.com/2020/03/coronavirus-stock-market-crash.html/

- https://monevator.com/weekend-reading-do-not-sell/

- https://www.visualcapitalist.com/history-of-pandemics-deadliest/

- https://www.history.com/topics/middle-ages/pandemics-timeline

- https://www.theguardian.com/commentisfree/2020/mar/05/even-as-behavioural-researchers-we-couldnt-resist-the-urge-to-buy-toilet-paper

- https://markets.businessinsider.com/news/stocks/stock-market-news-today-indexes-plunge-oil-market-coronavirus-selloff-2020-3-1028978137

- https://www.independent.co.uk/news/world/americas/coronavirus-cdc-1918-flu-pandemic-death-toll-symptoms-a9389171.html

- https://t.co/ZejfSQcO0Y?amp=1

- https://www.bbc.co.uk/news/science-environment-51825089

- https://www.bbc.co.uk/news/uk-england-york-north-yorkshire-51736395

- https://www.mortgagesolutions.co.uk/better-business/2020/03/02/equity-release-is-heading-into-the-eye-of-a-perfect-storm-blackwell/

- https://www.ft.com/content/fa038361-1faf-4083-8128-257f83d4b2ed

- https://www.bbc.co.uk/news/business-your-money-51841748

- https://www.theguardian.com/business/2020/mar/15/prepare-for-the-coronavirus-global-recession

- https://investornews.vanguard/a-message-from-vanguards-ceo-on-the-coronavirus/

- https://monevator.com/how-to-prepare-for-a-recession/

- https://www.cnbc.com/2020/03/01/millennial-millionaire-shares-what-he-refuses-to-spend-money-on.html

- https://metro.co.uk/2020/03/07/couple-ditch-jobs-retire-30s-live-greek-island-5000-year-12362827/

- https://ofdollarsanddata.com/the-worst-day-of-our-investment-lives/

- https://www.ukvalueinvestor.com/2020/03/hunting-for-dividends.html/

- https://www.finumus.com/blog/covid-19-and-bonds-no-time-to-die

- http://diyinvestoruk.blogspot.com/2020/03/asset-allocation-re-visited.html

- http://diyinvestoruk.blogspot.com/2020/03/national-grid-portfolio-addition.html

- http://www.retirementinvestingtoday.com/2020/03/lenses.html

- http://eaglesfeartoperch.blogspot.com/2020/03/thoughts-on-investment-portfolio.html

- http://eaglesfeartoperch.blogspot.com/2020/03/lockdown-in-tenerife.html

- https://gentlemansfamilyfinances.wordpress.com/2020/03/09/february-2020-month-end-accounts/

- https://awaytoless.com/monthly-spending-february-2020/

- http://quietlysaving.co.uk/2020/03/08/ravaged-dogs-of-the-ftse-and-random-shares-update/

- https://firevlondon.com/2020/03/10/feb-2020-buy-high/

- https://www.thefrugalcottage.com/my-updated-portfolio-march-2020/

- https://southwalesfi.co.uk/2020/03/13/innovative-finance-isa-pros-and-cons-ifisa/

- http://bankeronfire.com/pension-vs-isa-settling-the-debate

- https://pursuefire.com/playing-the-long-game/

- https://theescapeartist.me/2020/03/13/victory-is-inevitable/

- https://indeedably.com/prison-of-my-own-making/