One of the cardinal rules of financial security is to have an emergency fund. If you need to ask why, you’re in the wrong place, and I suggest you read Monevator’s excellent explanation (1). A big credit line isn’t enough. You need 3-6 six months of expenses in a liquid, easily-accessed account. For the basic rules and steps Monevator again has your back (2).

So far, so basic.

Beyond that the arguments start. What classifies as an emergency? How much is too much? Where do you put it?

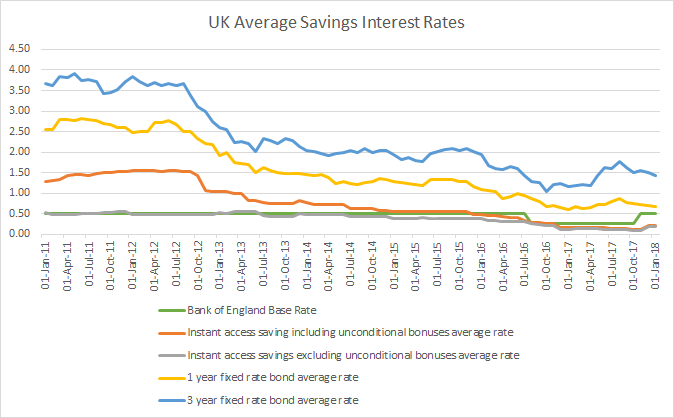

High yield current accounts and instant-access savings accounts have long been the go-to. Which was fine when returns were 3% plus in the early noughties, but over the past decade interest rates on savings accounts have drifted down (3, 4). The best easy access accounts, including the once-vaunted Marcus, are now returning 1.3% (5). Meanwhile inflation hovers around the 1.3-1.5% mark (6).

So we’re left with a dilemma: do we accept our emergency fund will (at best) tread water or (at worst) lose money relative to inflation, or do we chase returns?

The latter has led to some very creative accounting by some authors, including the suggestion that your emergency fund spending should be built into your household budget (7). Which sort of suggests it’s predictable, and not an unforseen emergency.

Or you could be like a number of other FIRE bloggers (Early Retirement Now, Physician on FIRE), and go without an emergency fund, relying instead on lines of credit and your investments to bail you out (8, 9). This reduces your opportunity cost and improves your returns (10). It also tackles the behavioural problem with an emergency fund; the temptation to dip into it for that emergency TV or holiday. It’s much harder to impulse spend an investment. But do you risk crystallising losses during the inevitable downturn?

Step forward premium bonds; long-derided though the UK’s biggest savings product (11). They’re a psychological leap from an instant access savings account, yet improvements in IT means you can check results on your phone and transfer into cash within a couple of days (ticking that liquidity box) (12, 13). The prize rate has been cut, but it’s still 1.3% – the same as instant access savings (14). And given you’re reading this and into FIRE, you’re probably a higher rate tax payer. Here premium bonds sweeten the deal further, with no tax to pay on winnings (15).

You’re still not likely to see a win, as that 1.3% is practically lower due to the skewing effects on the average of the top prizes. But maybe now, in the days of rubbish cash returns, premium bonds offer a credible emergency fund safe haven.

Have a great week,

The Shrink

…

P.S. Couldn’t really get away without mentioning the Coronavirus outbreak could I? I’ve briefly mentioned my thoughts in the Reasons to be cheerful/fearful post, and for how I think it’s going to go see Scenario 5 of the Thought Experiment. Ultimately it’s going to be a difficult time for the markets. Due to the number of unknowns we’re dealing with, trying to price in predictions is near impossible. The efficient market is going to struggle with the level of uncertainty. We’ve been near a market top for a long time. No-one knows the future. Stick with your plan and be confident in your preparation.

…

Other News:

Covid-19 mini-special:

- BBC coverage of the weeks stock losses (18)

- Bill Gates has an editorial in the New England Journal of Medicine on Covid 19 (19)

- The Guardian has a great summary of the spread so far (20)

- Last weekend’s Observer did not mince words in suggesting this is the Black Swan event (21)

- And the WHO thinks the world isn’t ready (22)

- And Nouriel Roubini reckons the market is too complacent (23) – FT

And elsewhere:

- Property prices have seen a bit of a bounce, along with an increase in sales (24)

- And data suggests the BTL tax changes have driven smaller landlords out, and concentrated property into larger portfolios (25)

- Musk cites Asimov’s Foundation Series as inspiration (26) – A mind ahead of his time

- There’s a plan to use the West Mids canals as water-source heat systems for housing (27)

- Conservatives are so desperate to counter climate change science they’ve sourced an anti-Greta (28)

- Meanwhile devastating floods continue, and those flooded are being scammed (29)

- In the markets, Virgin Galactic share price seems to be following it’s spaceplanes (30)

- While Klarna, one of the Fintech unicorns, posts a loss (31)

Opinion/ blogs:

- Vice’s new economics columnist akes us on a fairly wild ride, when it all starts out so relaxed (32)

- Morningstar has a fellow called Alan’s FIRE tale (33)

- While BBC Three covers a young forex trader (34)

- Monevator on the weeks activity (35)

- But RIT adds some perspective (36)

- And at this bargain time the eagle is buying in (37)

- Weenie has her Feb 2020 update (38)

- DIY Investor UK opens a position in SSE (39)

- John at UK Value Investor looks over Diageo (40)

- GFF moves his pension (41)

- TFS has an update following handing in his notice (42)

- CashFlowCop also has an update, with some major life events (43)

- TEA on maximising assets (44)

- The Ways at A Way To Less have a new arrival, and are assessing how it will impact their FIRE journey (45)

- The Frugal Cottage has a February update (46)

- As does Fu Mon Chu at FI UK Money (47)

- The Saving Ninja has launched an FI calculator mobile app (48)

- Banker On Fire has worked examples of the benefits of continuous contributions and time in the market (49) – One of a raft of new blogs that have come along since I last put up a Full English post. More to come…

- Michael at Foxy Monkey has a series looking a the impact of IR35 (50)

- Firevlondon provokes a lot of discussion when he shares his financial goals (51)

- Indeedably reflects on the factors that people weigh up changing job (52)

- And on holding people to their word (53)

References:

- https://monevator.com/its-an-emergency-fund/

- https://monevator.com/emergency-funds-the-ten-essential-steps/

- https://thistimeitisdifferent.com/uk-savings-interest-rates-feb-2018

- https://www.bbc.co.uk/news/business-49752883

- https://www.moneysavingexpert.com/savings/savings-accounts-best-interest/

- https://www.bbc.co.uk/news/business-51117888

- https://awealthofcommonsense.com/2019/09/what-do-i-want-my-money-to-do-for-me/

- https://earlyretirementnow.com/2016/05/05/emergency-fund/

- https://www.physicianonfire.com/dont-bother-with-emergency-fund/

- https://www.fool.com/investing/2018/04/15/people-are-thinking-about-emergency-funds-wrong.aspx

- https://www.moneysavingexpert.com/savings/premium-bonds/

- https://moneyfacts.co.uk/news/savings/nsi-enhances-its-premium-bonds/

- https://www.yourmoney.com/saving-banking/premium-bonds-winners-can-now-be-notified-by-text/

- https://www.moneysavingexpert.com/news/2020/02/premium-bond-prize-rate-to-be-cut-to-1-3-/

- https://monevator.com/are-premium-bonds-a-good-investment/

- https://twitter.com/i/status/1230554753182003203

- https://twitter.com/andrewgregory/status/1233076394084720640?s=19

- https://www.bbc.co.uk/news/business-51681620

- https://www.nejm.org/doi/full/10.1056/NEJMp2003762

- https://www.theguardian.com/world/ng-interactive/2020/feb/26/coronavirus-map-how-covid-19-is-spreading-across-the-world

- https://www.theguardian.com/business/2020/feb/15/coronavirus-black-swan-shadow-global-economy

- https://www.theguardian.com/world/2020/feb/26/coronavirus-spreads-further-as-who-expert-warns-world-not-ready-for-pandemic

- https://www.ft.com/content/e0ca01ee-57cb-11ea-abe5-8e03987b7b20

- https://www.theguardian.com/money/2020/feb/17/uk-housing-boom-leads-to-2500-jump-in-asking-prices

- https://www.thisismoney.co.uk/money/buytolet/article-8019811/Hundreds-thousands-landlords-sold-tax-relief-began-phased-out.html

- https://www.cnbc.com/2020/02/21/elon-musk-recommends-science-fiction-book-series-that-inspired-spacex.html

- https://www.theguardian.com/environment/2020/feb/17/west-midlands-canals-help-heat-hospitals-homes-plans

- https://www.theguardian.com/us-news/2020/feb/25/anti-greta-teen-activist-cpac-conference-climate-sceptic

- https://www.bbc.co.uk/news/uk-wales-51633458

- https://www.thisismoney.co.uk/money/investing/article-7978521/Is-worth-investing-space-stocks-Virgin-Galactic.html

- https://www.cityam.com/fintech-unicorn-klarna-posts-first-ever-annual-loss/

- https://www.vice.com/en_uk/article/qjd3p7/how-to-get-out-of-debt

- https://www.morningstar.co.uk/uk/news/199513/fire-means-i-can-retire-at-41.aspx

- https://www.bbc.co.uk/bbcthree/article/2b3f3f67-2338-4253-b7f5-a36192885492

- https://monevator.com/weekend-reading-bring-me-sunshine/

- http://www.retirementinvestingtoday.com/2020/02/perspective.html

- http://eaglesfeartoperch.blogspot.com/2020/02/the-end-of-world-as-we-know-it.html

- http://quietlysaving.co.uk/2020/02/28/february-2020-plus-other-updates/

- http://diyinvestoruk.blogspot.com/2020/02/sse-portfolio-addition.html

- https://www.ukvalueinvestor.com/2020/02/diageo-share-price.html/

- https://gentlemansfamilyfinances.wordpress.com/2020/02/28/bye-bye-aegon/

- http://thefirestarter.co.uk/resigned-to-my-fate/

- https://cashflowcop.com/so-near-and-yet-so-fi/

- https://theescapeartist.me/2020/02/28/sweat-those-assets/

- https://awaytoless.com/delaying-fire-to-enjoy-today/

- https://www.thefrugalcottage.com/february-2020-a-month-in-review/

- http://fiukmoney.co.uk/february-20-net-worth-and-monthly-update-18-525898-15143/

- https://thesavingninja.com/ficalc-ninja-mobile-application/

- http://bankeronfire.com/the-real-path-to-wealth?the-real-path-to-wealth

- https://www.foxymonkey.com/ir35-contract-market/

- https://firevlondon.com/2020/02/23/how-much-is-enough/

- https://indeedably.com/shedding-skin/

- https://indeedably.com/held-to-account/