What’s piqued my interest this week?

Caution, monster link-fest ahead.

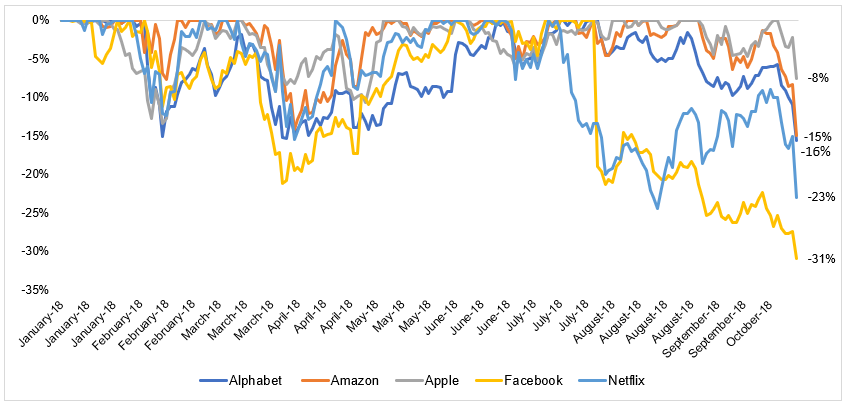

Well this has been a busy old week in the markets, eh? The FTSE sunk off the back of US losses, due in part to rising Federal Reserve interest rates (fuelling a drop in bond returns, therefore loss in confidence, therefore sell-off), and losses on tech stocks, particularly the FANG lot (1).

Lots of our compatriots have seen a slide… Monevator FirevLondon, RIT (2, 3). This is all excellent fodder for the press, who have called it everything from a correction, turbulence, to a “global market MELTDOWN, the beginning of the next CRASH” (4, 5). Hyperbole so ballistic SpaceX will be after the patents. And to be fair, lots of people have been voicing that we’re in the late stages of a bull market and we should be expecting a recession imminently. It only takes one person to yell fire to start a stampede.

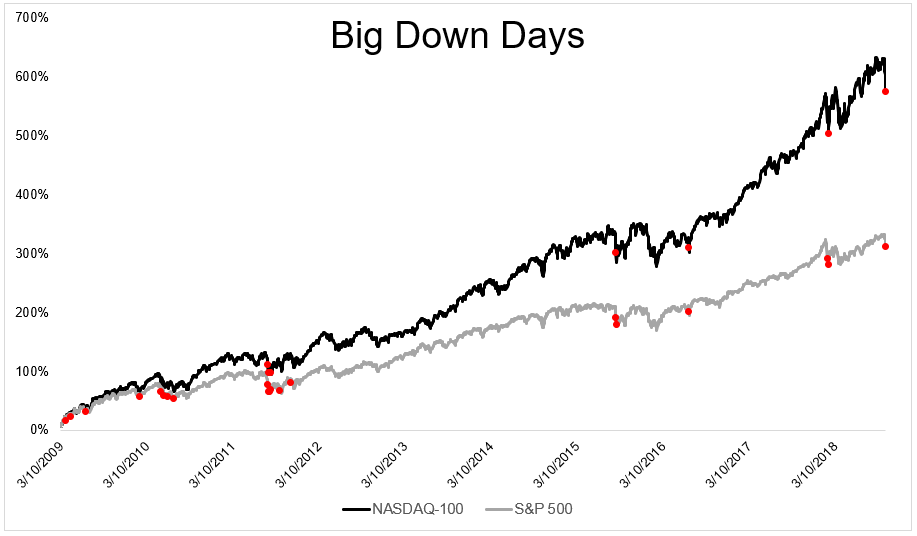

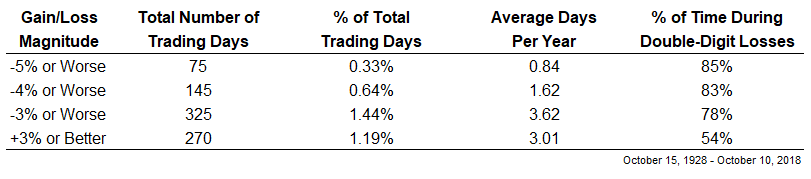

Look past the press, noise and short-term numbers and see that actually, big down days aren’t that uncommon. The US blogs A Wealth of Common Sense and the Irrelevant Investor both had some excellent posts on this (6, 7, 8). Shamelessly stealing their graphs and tables, this was the 20th -3% day on the S&P 500 since the end of the 2008 bear, however 80% of 3+% down days were in a sell-off/ recession.

What does this tell us? You can’t predict the future, especially looking at just one measure, and if you’re well diversified and holding long term it shouldn’t matter. And will we even see a ‘great crash’? People are jumping on index investing in ever greater numbers, spurred on by pieces like this weekends NYT article (9). This is supported by the Morningstar Barometer continuing to show passive beating active returns over the past 10 years (10, 11). Ten years of passive investors watching an incoming tide lifting all boats has had people warning of the end of active investing (12). Passive ETFs had grown to an estimated 35% market share by 2017 (13). I couldn’t unearth more recent figures, but it seems reasonable that this will have grown in the last year. Even the great Bogle was warning of danger. But if 35%+ of the market is in trackers which move with the market, what effect will this have on when the market moves? If all the trackers are holding, or at least slow in their re-balancing, theoretically it should create an undercurrent of stability within the market, mitigating investor psychological panic moves. Additionally, for us Brits, Brexit has introduced such a level of uncertainty into the UK economy that perhaps people have been holding off while across the pond they’ve continued to make hay. I bloody love YFG’s post this week on this very topic (14).

It’s also worth remembering many young investors (me, etc) have no experience of big down days and drops. I was doing my best to get horizontal at pound-a-pint student nights during the last recession. Woohoo, cheap beer! And as someone with a lifetime of saving ahead, I should be praying for a recession (15). I’m sitting tight at the moment. In my Q2 goals it was a target, but this was naive. Had I stuck all my money in Wolf Minerals as I planned when I was first starting out, I’d be buggered (16). Instead I’m going to continue building my emergency fund in cash, set a solid plan and keep a finger in the air to see which way the wind is blowing. To mix metaphors, I’m going to get myself fully shipshape before bracing any storm.

If there is a storm. Howdy Callum!

Have a great weekend,

The Shrink

Side Orders

Other News

- Pat Val has been rarely out of the news this week, thanks to ‘creative accounting’, I look forward to the YFG piece (17)

- We had the cracking moment the Banksy painting shredded itself (18)

- Lots of coverage this week about the research that showed a massive reduction in meat-eating would be necessary to prevent climate ‘breakdown’. I’ll be returning to this next weekend (19)

- Biggest bond ETF suffers record withdrawals (20)

- Lots of interesting coverage about WHSmith, as it restructures to more airport/ service station and away from the high street (21)

- The treasury look to tighten loopholes for small traders taxes, flatly ignoring massive companies (22)

- RBS launches a market-leading ISA to compete with Goldman-Sach’s Marcus (and sees a dividend) (23)

- Brexit uncertainty is upsetting the property market (24)

- The Big 6 are suffering (25)

- Mutterings Hammond will cut pension tax relief (26)

- Revolut releases data that UK millenials have crap pay and high expenses (27)

Opinion/ blogs:

- BBC Health – Should we be forced to pay £30k for old-age care (28)

- BBC Business – why you have (probably) bought your last car – I’ll be coming back to this too, because it’s a pile of London-centric shite (29)

- TFS reports on his September (30)

- As does Wephway (31)

- MMM breaks it down (32)

- The Greybeard at Monevator contemplates his retirement (33)

- Ratesetter have been re-analysed and re-jigged (34)

- YFG likens financial independence to dieting (35)

- Lots of FI-ers have been completing a ‘million pound thought experiment set by Savings Ninja (36):

- The Irrelevant Investor – Built to break (40)

- A Wealth of Common Sense – The case for bonds (41)

- One from DIY Investor UK on climate change (42)

- Morningstar – which markets are preparing to transition to a low-carbon economy (43)

- Indeedably – Accountability can’t be outsourced (44)

- TEA has a guest post – Get rich with hobbies (45)

- MsZiYou has launched her UK FI podcast, here’s the one with Mr&Mrs YFG (46)

- A nice reminder in the Guardian of the benefits of a frugal life (47)

- John at UKVI – Is HL’s dividend yield too low for income investors (48)

The kitchen garden:

- Jack Wallington, a professional gardener and allotment owner (49)

- Sharpen your spaces, on growing your own garlic (50)

- Annabelle at No.27 on the autumn glut (51)

What I’m reading:

Smashed through The Windup Girl in a week, fantastic atmosphere but a bit of a damp squib in the end. On to… La Belle Sauvage: The Book of Dust Volume One – Philip Pullman

Religio Medici and Urne-Buriall by Sir Thomas Browne – the theological and psychological reflections of a C17th doctor.

Enchiridion by Epictetus – Bedside reading for a bad day

References:

- https://www.theguardian.com/business/2018/oct/11/why-are-stock-markets-falling-and-how-far-will-they-go

- http://monevator.com/weekend-reading-looking-down-when-the-tide-goes-out/

- http://www.retirementinvestingtoday.com/2018/10/2018-quarter-3-review-readying-for-fire.html

- https://www.theguardian.com/business/2018/oct/12/ftse-100-falls-to-six-month-low-amid-fears-over-us-interest-rates

- https://www.express.co.uk/finance/city/1030145/global-markets-meltdown-equity-financial-crash-why-global-markets-are-down-today

- https://awealthofcommonsense.com/2018/10/big-down-days/

- https://theirrelevantinvestor.com/2018/10/10/u-g-l-y/

- https://theirrelevantinvestor.com/2018/10/09/a-bullish-washout/

- https://www.nytimes.com/2018/10/12/business/index-fund-investors-simpler-approach-may-enrich-returns.html

- https://www.fnlondon.com/articles/passive-beat-active-over-the-past-decade-finds-morningstar-20181001

- https://www.moneyobserver.com/news/active-funds-have-underperformed-passive-all-two-sectors

- https://bit.ly/2CJjgNY

- https://www.forbes.com/sites/greatspeculations/2018/09/19/are-we-headed-for-a-passive-index-meltdown/#137fbde4413e

- https://youngfiguy.com/brexit-and-finance/

- https://awealthofcommonsense.com/2018/10/who-benefits-from-a-market-correction/

- https://www.bbc.co.uk/news/uk-england-devon-45812974

- https://www.bbc.co.uk/news/business-45854817

- https://www.bbc.co.uk/news/uk-england-bristol-45770028

- https://www.theguardian.com/environment/2018/oct/10/huge-reduction-in-meat-eating-essential-to-avoid-climate-breakdown

- https://on.ft.com/2PrHbnT

- https://metro.co.uk/2018/10/11/wh-smith-to-start-closing-stores-as-it-struggles-on-the-high-street-8027099/

- https://www.bbc.co.uk/news/business-45822650

- https://www.independent.co.uk/news/business/news/rbs-savings-account-best-interest-rate-goldman-sachs-a8578996.html

- https://www.theguardian.com/business/2018/oct/11/brexit-uncertainty-taking-toll-property-market-rics-research

- https://www.theguardian.com/business/2018/oct/11/profits-slide-at-big-six-energy-firms-as-14m-customers-switch

- https://www.moneywise.co.uk/news/2018-10-08/chancellor-philip-hammond-planning-to-cut-pension-tax-relief-the-autumn-budget

- https://www.theguardian.com/money/2018/oct/13/uk-millennials-costs-eu-pay-rent-transport-grocery-revolut

- https://www.bbc.co.uk/news/health-45750384

- https://www.bbc.co.uk/news/business-45786690

- http://thefirestarter.co.uk/september-income-expenses-report-up-and-running/

- https://deliberatelivinguk.wordpress.com/2018/10/05/september-2018-review/

- http://www.mrmoneymustache.com/2018/10/05/the-fire-movement/

- http://monevator.com/preparing-to-take-a-retirement-income/

- http://monevator.com/ratesetter-high-interest-offer/

- https://youngfiguy.com/financial-independence-and-dieting/

- https://thesavingninja.com/what-would-you-do-if-you-got-given-1-million/

- http://www.msziyou.com/if-i-won-1m-tomorrow/

- http://thefirestarter.co.uk/the-million-pound-question/

- https://indeedably.com/million-pound-question/

- https://theirrelevantinvestor.com/2018/10/08/built-to-break/

- https://awealthofcommonsense.com/2018/10/the-case-for-bonds/

- http://diyinvestoruk.blogspot.com/2018/10/climate-changebe-change.html

- https://www.morningstar.com/blog/2018/10/01/low-carbon-economy.html

- https://indeedably.com/accountability-cant-be-outsourced/

- https://theescapeartist.me/2018/10/09/get-rich-with-hobbies/

- http://ukfipod.space/004/

- https://www.theguardian.com/money/2018/oct/13/because-of-my-upbringing-ive-always-been-careful-with-money

- https://www.ukvalueinvestor.com/2018/10/hargreaves-lansdown-dividend-yield.html/

- https://www.jackwallington.com/allotment-month-34-happy-herbal-apple-disaster-persistent-prairie/

- https://sharpenyourspades.com/2018/10/11/love-garlic-then-you-have-to-grow-your-own/

- https://lifeatno27.com/2018/10/01/spuds-gluts-and-deliciousness/

Having been investing for coming up 10 years (coincidentally around the same time as the chart from AWOCS) I can tell you I certainly felt those ‘down days’. I do find it slightly amusing the talk of the ‘Longest Bull Market in History'(TM). It did not feel like that in 2011/12 and in 2015. I distinctly remember standing with my boss in a foyer before a meeting watching BBC News talk about ‘the market turmoil’ and saying to him “I wish I had more money to throw into the stock market right now” – he had a look to me as if to say “your money is in the stock market?”

But I can see also how forgetful we are. I can barely remember the hiccup in early 2018, but having just looked at my spreadsheet it wiped tens of thousands off of my net worth. I don’t recall even blinking. Maybe my mind is playing tricks on me.

p.s. Thank you as ever for the links, very pleased to hear you enjoy my ramblings!

LikeLiked by 1 person

Windup girl is next on the to-read pile, seen some very mixed reviews of it. I really loved the Book of Dust, hope Mr. Pullman doesn’t take too long on the next one. Excellent links, as usual. More gardening stuff please!

LikeLiked by 1 person

I’ve been following all the ‘hysteria’ in the news with interest too but decided not to torture myself by checking to see how much my portfolio had gone down by. Didn’t see the point, as I didn’t need to know. Although I’ll be doing my usual end of month update so if things haven’t recovered, well, I’ll see the damage then but such is the stock market’s ups and downs.

Some great links there which I’ll have to catch up on! And Book of Dust is on my to-read list!

LikeLiked by 1 person