Quarterly return posts supplement my monthly Financial Dashboard, covering investments in detail and looking at my yearly targets. Here I track purchases and sales, document progress against my (in progress) investment strategy, and discuss re-balancing and changes over time.

A quarter of lockdown, three months blur of work, DIY and our own four walls. Did we save well?

Q2 Returns:

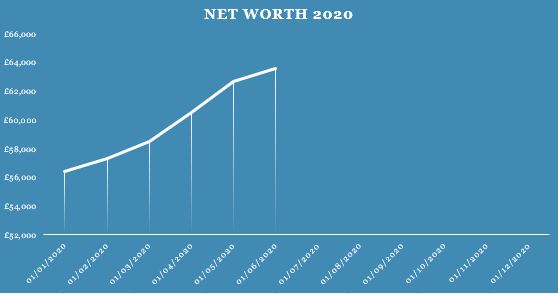

Net worth excluding my DB pension & student loan

- Cash Savings Accounts £12,200 (+1,900)

- Investments £5,100 (+£,1900)

- Property £42,900 (+£1,300)

- Cars £2000 (no changes)

Gradual increases across the board. My net worth excluding my NHS pension continues to climb, though I expect a plateau over the next few months with property renovation spending.

Yearly Targets:

Goal 1: Build an emergency fund

My first 2019/20 goal was to build an emergency fund, as per the r/UKpersonalfinance flow chart (1). My goal emergency fund is three months total household expenses (£6k) in my name, plus a further three months (£6k) held jointly.

This has steadily increased, but recent DIY and impending builders/ plumbers/ electricians fees mean that attempts to stay above £10k are unlikely. The goal remains achievable.

Goal 2: Save 30% of my income

I calculate my savings rate using this formula:

Savings rate as % = ((Income – spend) + Cash savings + Investments + Pension contributions) / (Income + Pension contributions)

YTD Savings Rate

Lockdown has pushed my savings rate up, to a best ever rate of 57% in May. This has now dropped back, but my year average to date is still 40%, well above my target.

Goal 3: Calculate savings made by growing my own food

So I started my garden notebook at the start of the year, charting what I’d sown, what grew well and didn’t, and spending/ returns. As things were sown in Q1 it was all expenses, but now I’m starting to get some growth and profit! The first tomatoes, potatoes, lettuces and other salads have been harvested. I’m estimating about £20 worth of home-grown produce consumed so far, so still negative on my £30 of seeds. Roll on the harvest, and a spreadsheet of produce.

Goal 4: Make changes to reduce carbon footprint

Working from home to an extent, no foreign travel, no major new purchases means our carbon footprint should be well down on last year. We continue to eat local produce, and use Splosh (2). They’re a zero waste refillable start-up, and unlike most of the eco washing stuff we’ve tried, their stuff actually works really well. You order a starter pack which includes refillable plastic bottles, and then they send you the concentrated product which you mix in the bottle. When the concentrate is done you send it back to them and they recycle it, or some of them are compostable. After several months of using their stuff I’ve found we actually use less than we would if it was shop bought, so it ends up cheaper. If you want to give it a go use referral code YQL240THX1 to get 15% off.

Goal 5: Automate investments and savings

I’ve automated my FreeTrade investment and building society regular saver this quarter. The bounce back in the markets means I’m currently sat at total absolute return across my investments of 7.62%. Note this is absolute figure for what has my invested figure returned, without inclusion of time/ rate of return. No XIRRs here. Good returns for my ex-UK Dev World holdings have been handicapped by purchases at the start of the year of Emerging Markets and Global All-Cap, fairly near high water marks. Those are only now back in the green.

Core/ Satellite Passive/ Active Split

At the start of the Quarter I bought further into Vanguards ex-UK Dev World, pretty close to the bottom of the dip. That small purchase is up 22%. In my FreeTrade account I bought Greencoat UK Wind (UKW) and The Renewables Infrastructure Group (TRIG). This brings me closer to my 80/20 passive/active split. My active investment choices have several purposes. UKW and TRIG are both in there to provide long-term stability (particularly present in my thoughts at the time of purchase), diversification and potential dividends. They’re also part of an attempt to purchase and invest my money sustainably. I won’t go into the fund particulars in detail, as both DIY Investor UK and GFF cover UKW (3, 4), whilst DIY Investor UK has covered TRIG a fair bit (5, 6). Both holdings were purchased at a premium, and they continue to run ~109% price/NAV. I still need to integrate my crowdfunding investments into my portfolio spreadsheet, along with tidying up my global allocation data. For now I’m holding a bit of cash spare in case of another crash, and will continue to drip feed every month in an automated way.

Fancy a free share? Sign up to Freetrade using this link, and we both get one.

Hope everyone else is seeing bounce back bonuses,

The Shrink

References:

- https://www.reddit.com/r/UKPersonalFinance/

- https://www.splosh.com/how-it-works

- http://diyinvestoruk.blogspot.com/2019/07/greencoat-uk-wind-portfolio-addition.html

- https://gentlemansfamilyfinances.com/2019/05/17/green-money-greencoat-uk-wind-share-offer-may-2019/

- http://diyinvestoruk.blogspot.com/2019/02/renewables-infrastructure-new-addition.html

- http://diyinvestoruk.blogspot.com/2020/02/trig-full-year-results.html

I did like the look of TRIG, but ongoing charge of over 1% (and a premium of nearly 20%) ufffff, doesn’t make it a cheap one for the moment. I do have a small wedge in Greencoat- just continues goes up and up though.

LikeLike

Hey South Wales FI,

I was lucky enough to buy in when the premium was <10%, since when the price has gone up around 10% alone. I accept the 1% charge on the basis that it's essentially functioning as a REIT holding things I could never own independently, but agree it is a bit steep compared to the usual suspects.

I don't think TRIG or UKW are going down any time soon.

The Shrink

LikeLike