When I first started writing this blog I set out a very brief goal:

Financial independence for myself and MrsFireShrink.

But beyond that, the aim is to save a sufficient amount to create a self-sustaining portfolio. The dream goal being to create a portfolio sufficient to support my family in the future and continue to grow (1).

Which is all a bit wishy-washy. Over the course of the year I’ve realised that I need to firm up my yearly goals, and also articulate more clearly my long term dream. This was put into sharp focus by a few recent blog posts, including indeedably’s goals, strategy and tactics (2). Elsewhere in life I’m fairly SMART in my goals, with monthly and yearly targets.

“Sound tactics bring victory” – Shaxx

So here’s the current goals list with steps already taken and timescale for target/ dream (a-la indeedably) (3). (Last updated Jan 2020).

Complete medical degree.Achieve Royal College Membership.Become a consultant (2028).Find a girl.Get married.Have kids (2028). Have good kids.Publish a paper (2018). Get a fellowship (2019). Get another fellowship (2019).Get a Phd. Get a lectureship. Make Prof.Get a job.Get a job I enjoy.Get a job which doesn’t feel like work (2020). Be in a position to retire in 15 years (2033).Have an emergency fund of three months income (2019).Save £1000/month (2020). Have a net worth of £100k.Own a home.Have £100k in equity (2023). Own our dream home in 10 years (2028). Own a self-sustaining estate.Learn to drive.Own a car.Own a six-cylinder car.Own an eight-cylinder car (2028).Race in a motorsport.Win a race (no timescale).Start a martial art.StartGet to sho dan (no timescale).gradeing.- Learn to ride a motor bike.

- Learn to fly a plane.

Do 50 press-ups.Do a pull-up (again) (20192020). Get back to 16 stone (20192020). Do a hand-stand press-up (again). Do a ring muscle-up.- Re-learn languages I once knew. Become fluent in one of them. Learn a fourth language (no timescale).

The numbers

Most of the maths in this section is rough and dirty. I’m not going to make complex predictions or models. Life itself is too unpredictable (even if the money isn’t), and some recent health concerns have demonstrated the fallacy of trying to predict the future. I’ll review my household expenses more formally in a couple of years, and may come back and model timescales then.

- Be in a position to retire in 15 years (2033).

A review of the 10 months I’ve tracked so far shows my personal yearly expenditure (minus credit card payments and one-offs for this year) to be around £10k. To this I’ll add £2.5k to cover lifestyle inflation. Our joint account also goes through around £10k a year in running costs for the house, groceries, energy etc. I conservatively therefore need around £22.5k a year to maintain our current lifestyle if I didn’t work. This fits nicely with what the fun Standard Life calculator reckons for our current lifestyle (~£23,000) (4).

Plugging that into a simple interest calculator suggests I need to have around £650,000 saved to be able to withdraw £22,752/year at a reasonable 3.5% interest rate with no erosion of capital. This presumes the savings will be tax-sheltered. This seems pretty unachievable from a standing start, but I love a moonshot (5). I’ve selected 3.5% as a conservative blend of cash interest rates (currently 1.5%) and the average annual return of the FTSE All-Share over the last 100 years (+7.0%) (6). It’s also conveniently the mythical Perpetual Withdrawal Rate (7, 8).

You say: “Why are you not interested in drawdown? You’d get to retirement a lot quicker.”

This seems to be a fundamental schism in the investing/ FI community. I think it’s highly personal, and relates among other things to your optimism for your life expectancy, number of dependents and general approach to lifestyle. The figure above would replace my current salary (9). I have a pipe dream goal relating to my families history and future inheritance, and therefore I’ve no interest in drawdown.

- Have an emergency fund of three months income (2019). Save £1000/month (2020). Have a net worth of £100k.

These are all stepping stones on the route to the previous bullet point. Plugging that £650,000 into Money Advice Service’s savings calculator suggests I need to be saving £2300/month at 6% interest to achieve retirement by 2033 (10, 11). Yikes. 110% of my current take home. Thankfully my income should ramp up in the next few years, and while I’m quite a way from £2300/month now, it’s probable that I will reach that in the next 10 years. Just in time to miss my target.

- Have £100k in equity (2023). Own our dream home in 10 years (2028). Own a self-sustaining estate.

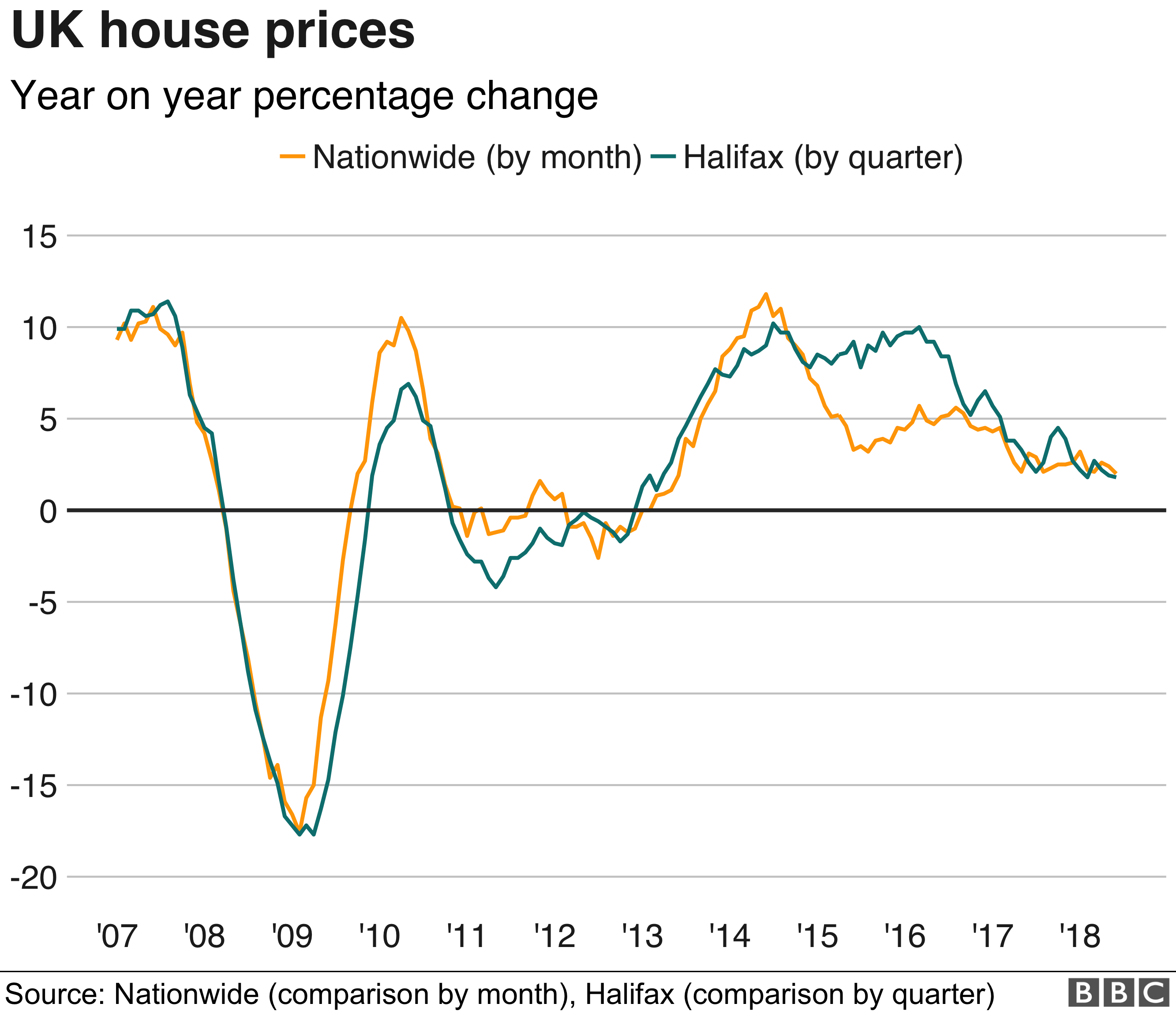

Currently our dream homes cost around £500k. Difficult to say what that will be in 10 years time. Historically the yearly trend has been c2.9% (12). More recently it’s closer to 2%, comparable to the OECD 2.0% long-range inflation forecasts (13, 14). Inflating the £500k at 2% brings us to £610k in 2028. Our feet are on the ladder, which mean we also benefit from that inflation to an extent.

We envisage another move in 5 years time, and I’m not averse to value-adding property renovation. I’m therefore aiming for some stepping stones to a solid deposit for the move to a dream home in 10 years.

Summary:

- Have an emergency fund of three months income (2019)

- Save £1000/month (2020)

- Be worth £100k (2022)

- Have £100k in equity (2023)

- Be in a position to retire in 15 years (2033)

In the next post I’ll cover my asset allocation.

Take care,

The Shrink

References:

- https://thefireshrink.wordpress.com/about-me/

- https://indeedably.com/goals-strategy-and-tactics/

- https://indeedably.com/i-will/

- https://www.standardlife.co.uk/c1/guides-and-calculators/retirement-how-much-may-i-need.page

- https://singularityhub.com/2016/11/15/this-is-how-to-invent-radical-solutions-to-huge-problems/#sm.000003z7yn60ncsavol2a9f74o5he

- http://stockmarketalmanac.co.uk/2016/12/100-years-of-the-ftse-all-share-index-since-1917/

- https://youngfiguy.com/safe-withdrawal-rate/

- https://portfoliocharts.com/2016/12/09/perpetual-withdrawal-rates-are-the-runway-to-a-long-retirement/

- http://monevator.com/try-saving-enough-to-replace-your-salary/

- https://www.moneyadviceservice.org.uk/en/tools/savings-calculator/

- http://candidmoney.com/calculators/investment-target-calculator

- http://monevator.com/historical-uk-house-prices/

- https://www.bbc.co.uk/news/business-44736472

- https://knoema.com/rwbagv/uk-inflation-forecast-2018-2020-and-up-to-2060-data-and-charts

I haven’t played Destiny 2 in almost a year, but I can still hear Shaxx’s voice when I read that quote!

Looks like you’ve got a good mix of goals there. I’m curious what “fellowship” means in relation to the medical profession. In my area (scientific academic research), a fellowship would almost always come after a PhD, and would usually be called a research fellowship, i.e. you had successfully applied for funding to enable you to carry out your own research. This is typically before ‘tenure’ where you become a lecturer / reader (i.e. a permanent member of staff). Having said that, I don’t think tenure exists in the UK, at least, not in the same capacity as the US. I would assume that the equivalent thing in a UK university would simply be a permanent position. From my understanding, tenure means that you can’t be fired, which, as I said, I don’t think exists in the UK. I could be wrong though, or it may vary from discipline to discipline.

LikeLiked by 1 person

I’m a clinical academic researcher, so essentially the same as your area. There are very few funded PhDs for clinicians, so to complete a PhD we have to acquire our own funding. Fellowships for us can either fund a PhD +- further work, or fund work as a Postdoc. The word has a looser meaning I guess.

I use ‘tenure’ as it’s a lay simplification. Clinical academics go through the same process to secure a lecturer/ reader post. They often retain an honorary clinical contract, but the focus is on either teaching or research (measured through output). I think you can be fired anywhere. I guess what I mean is a permanent position where the University funds your salary, not grants.

LikeLike

Ah, I see. Thanks for explaining.

I was/am very lucky in that there is a lot of funding for science PhDs, so I was able to start one immediately after my undergrad degree.

It’s always interesting to hear how other disciplines work, thanks for sharing!

LikeLiked by 1 person

That is a nice well rounded list of hopes and dreams there.

I was impressed by the save “110% of my current take home” goal, that would be quite the magic trick to carry off! Good luck with the advancement and (hopefully) accompanying pay rises.

What sort of motorsport floats your boat?

I had a go in an open wheeler around Silverstone once, was a lot of fun. The straights didn’t seem that fast, but wow did the corners approach quickly! I didn’t win, didn’t come last either. Most importantly: I wasn’t the guy who threw up inside his helmet.

LikeLiked by 1 person

Cheers indeedably! The 110% is eminently possible. One of the benefits of working for the NHS is a nationally published pay progression scale, which steps with my experience and seniority. I can therefore predict pretty well that (as long as I meet the requirements) my pay will have doubled in 10 years.

I’ve grown up around historic racing and tuning (on a very amateur cheap level), so have petrol in the blood. I race a few times a year in a fairly niche sport, which would completely destroy my anonymity if mentioned! Suffice it’s cheap (now I’ve forked out for the gear), cheerful and gives an adrenaline buzz. Racing could definitely become a moneypit in the future. If we ever meet at one of these FI-meetup-deals I’ll explain more.

Thanks for reading,

The Shrink

LikeLike

Thanks for sharing your goals.

You may not need as much as £650k. When you reach pension age (68?), part of the £22,752 you need will be topped up by state pension.

This is currently £8,575.55, and will go up with inflation etc.

So even if using this current figure, you would only need £14,177 from your pot from age 68? Or do you see the state pension as just a ‘bonus’?

LikeLiked by 1 person

Hi weenie,

I’ve deliberately not included pensions in my goal figures. Partly this is to simplify things, partly a hedge against lifestyle inflation, and partly to set myself ambitious targets to achieve. My state pension and my NHS pension both kick in at 68. My NHS pension is being continually watered down, but remains a decent defined benefit deal. It’s hideously complicated, even more so if you take a lump sum or retire early, and I’m still trying to get my head round the numbers. The NHS pension prediction software reckons if I take up my pension at 68, having retired 15 years early but not drawn on my pension, then I’d be looking at about £40k per annum. A nice little ‘bonus’! Unfortunately I can’t see the NHS being able to afford the pensions burden of the current NHS staff, so I’m expecting it to get raided at some point in the future. Such is life as a public servant!

LikeLiked by 1 person